Decoding Apollo Micro Systems Share | Is This the Next Big Thing?

Let’s be honest, the stock market can feel like navigating a maze. There are so many companies vying for your attention, each promising the moon. But how do you separate the real contenders from the flash-in-the-pan fads? That’s the million-dollar question, isn’t it? Today, we’re diving deep into Apollo Micro Systems share , a company that’s been generating a lot of buzz lately. But before you jump on the bandwagon, let’s understand what they actually do and, more importantly, why it matters.

What Exactly Does Apollo Micro Systems Do?

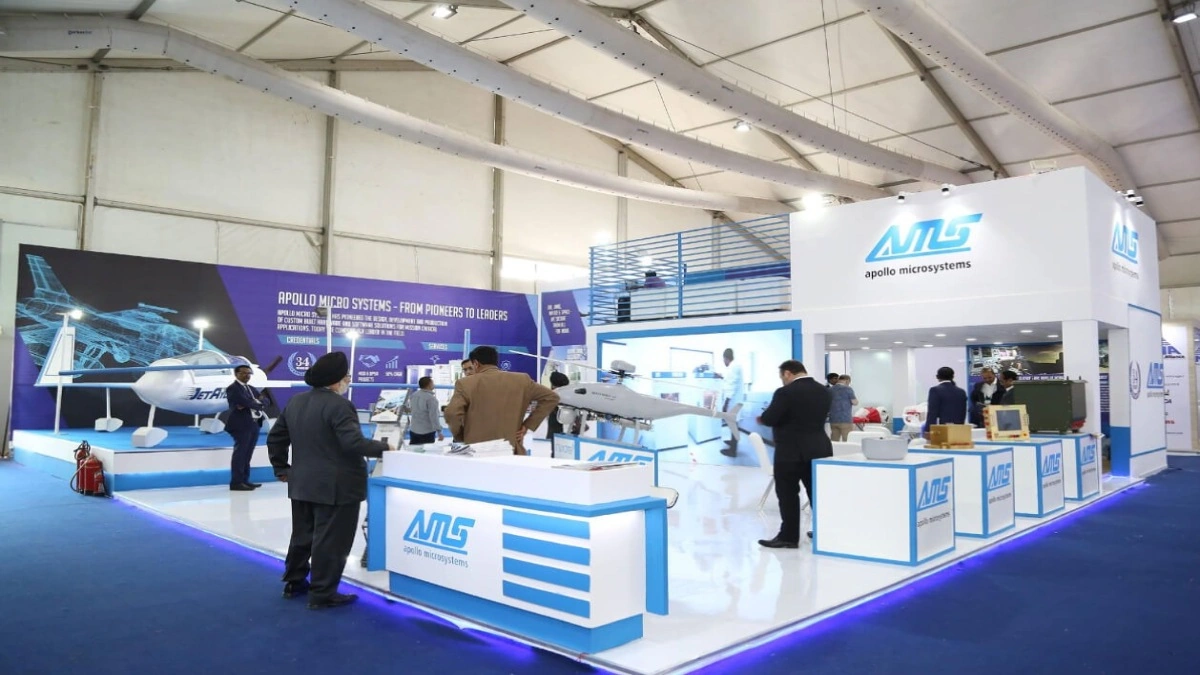

Apollo Micro Systems, at its core, is an engineering solutions provider. They’re not your average software company or e-commerce giant. Instead, they specialize in designing, developing, and assembling sophisticated electronic systems. Think of them as the brains behind some of the most advanced tech in the aerospace, defense, and homeland security sectors. They’re the ones building the critical components that make these systems tick. What fascinates me is their focus on high-reliability systems – meaning, systems that absolutely cannot fail. This niche focus is a key differentiator.

Their portfolio includes everything from missile guidance systems to underwater electronics and ruggedized computers. The scale of their projects is impressive , and their client list often includes government organizations and large defense contractors.

The “Why” Angle | Why Should You Care About This Sector?

Here’s the thing: the defense and aerospace sectors are undergoing a massive transformation. India’s focus on self-reliance (Atmanirbhar Bharat) and indigenization of defense production is creating a huge opportunity for companies like Apollo Micro Systems. Defense sector growth is expected to continue at a significant pace.

But it’s not just about government policy. Global geopolitical tensions are also on the rise, driving increased demand for advanced defense technologies. And that’s where Apollo Micro Systems comes in. They’re perfectly positioned to capitalize on this trend by providing critical components and systems for India’s growing defense needs. This makes investment in defense stocks an interesting prospect for many. But, and this is a big but, it also means they are susceptible to risks, such as changes to government policy.

The Indian government’s initiatives like ‘Make in India’ have further boosted local manufacturing and technology development. This supportive ecosystem allows Apollo Micro Systems to expand its capabilities and market reach. This shift towards local production reduces reliance on foreign imports and strengthens the domestic defense industrial base.

Decoding the Financials | What Does the Balance Sheet Tell Us?

Now, let’s talk numbers. Analyzing a company’s financials can feel like reading a foreign language. But it’s crucial to understand the basics. Look at their revenue growth – is it consistently increasing? What about their profit margins? Are they healthy? A deep dive into Apollo Micro Systems financial analysis will reveal insights into the company’s financial health and growth potential.

What fascinates me is how small companies can become giants in the future. The company’s debt levels, cash flow, and overall financial stability are important indicators. Always compare these metrics against industry peers to get a realistic view. It’s not just about past performance, but also about future prospects.

Remember, past performance isn’t necessarily indicative of future results. However, consistently strong financials provide a solid foundation for long-term growth. Keep an eye on the company’s order book – this gives you an idea of their future revenue pipeline.

Risks and Challenges | It’s Not All Sunshine and Roses

No investment is without risk. Let’s be realistic, there are challenges on the horizon. The defense sector is heavily regulated, and companies like Apollo Micro Systems are subject to strict compliance requirements. Any changes in government policy or regulations could impact their business. What is the regulatory landscape for defense industry regulations ?

But that’s not all. Competition is fierce, with both domestic and international players vying for market share. Apollo Micro Systems needs to constantly innovate and maintain its technological edge to stay ahead of the curve. And, of course, there’s always the risk of project delays or cancellations. So, it’s essential to consider these potential risks before making any investment decisions.

Supply chain disruptions, economic downturns, and geopolitical events can also influence the company’s performance. It’s crucial to stay informed about these external factors to assess their potential impact.

The Future Outlook | Where is Apollo Micro Systems Headed?

So, what’s the verdict? Is Apollo Micro Systems share a worthy investment? Well, it depends on your risk tolerance and investment goals. The company operates in a high-growth sector and is well-positioned to benefit from India’s focus on defense indigenization. However, it’s also important to be aware of the risks and challenges involved. So, do your homework, consult with a financial advisor, and make informed decisions. Always consider long term investment strategies when making investment decisions.

The future looks promising for Apollo Micro Systems, with potential for further expansion and innovation. The company’s focus on high-reliability systems and strategic partnerships positions it for long-term success. But remember, patience is key in the stock market.

FAQ Section

Frequently Asked Questions about Apollo Micro Systems Share

What does Apollo Micro Systems specialize in?

Apollo Micro Systems specializes in designing, developing, and assembling electronic systems for the aerospace, defense, and homeland security sectors.

What are the key growth drivers for Apollo Micro Systems?

Key growth drivers include India’s focus on self-reliance in defense, increasing global geopolitical tensions, and government initiatives like ‘Make in India’.

What are the main risks associated with investing in Apollo Micro Systems?

Risks include regulatory changes, intense competition, project delays, and external factors like supply chain disruptions and economic downturns.

How can I assess the financial health of Apollo Micro Systems?

Analyze their revenue growth, profit margins, debt levels, cash flow, and compare these metrics against industry peers.

Is Apollo Micro Systems considered a small-cap or large-cap company?

Apollo Micro Systems is generally considered a small-cap company, characterized by its smaller market capitalization.

Where can I find the latest updates on Apollo Micro Systems?

Stay up-to-date by checking reputable financial news websites, company press releases, and reports from financial analysts.

Ultimately, the decision to invest in Apollo Micro Systems share rests with you. Armed with the right information and a clear understanding of your own investment goals, you can navigate the market with confidence. But remember, the stock market is a marathon, not a sprint. So, stay patient, stay informed, and stay the course.